Mica License in Lithuania

Regulation 2023/1114 of the European Parliament and of the Council (EU), adopted on 31 May 2023, established a pan-European legal framework for the regulation of cryptoasset markets and amended earlier acts, including Regulations (EU) No 1093/2010, No 1095/2010, as well as Directives 2013/36/EC and (EU) 2019/1937. The document is known by the acronym MiCA (Markets in Crypto Assets Regulation) and has become a fundamental legal instrument defining uniform requirements for the issuance, admission to circulation and provision of services related to cryptoassets within the European Union.

MiCA establishes a two-stage application of its rules: from 30 June 2024, the provisions governing issuers of stablecoins (including asset-backed tokens and electronic money tokens) come into force, and from 1 January 2026, all other provisions, including requirements for cryptocurrency service providers, come into force. The detailed content of the regulatory requirements is developed and set out in the relevant technical standards (RTS and ITS), as well as in the guidelines formed at the level of the EU supervisory authorities – ESMA and EBA.

In order to harmonise European legislation with MiCA, on 11 July 2024, the Republic of Lithuania adopted a national Law on Cryptoasset Markets and made accompanying amendments to the existing legal regulation. As part of this transformation, the Bank of Lithuania was officially designated as the authority responsible for the supervision and licensing of cryptoasset-related service providers. A transition period of five months has been established for crypto companies already operating on the market. From 30 December 2024, they will be entitled to apply for a licence, and from 1 June 2025, their activities will be permissible only if they have a relevant licence from the Bank of Lithuania. Otherwise, the provision of virtual currency exchange and cryptoasset storage services will become illegal. Starting from 2024, the Bank of Lithuania started extensive preparations for the launch of the licensing system. Specialised information sections were created on the regulator’s official website, available in Lithuanian and English. On 22 August 2024, a statement on regulatory expectations for cryptoasset service providers was published to guide market participants on the content of future requirements. In parallel, the Bank of Lithuania organised a series of consultation events, including two specialised seminars in June and October 2024, attended by more than 200 representatives of the cryptocurrency industry. In addition, four thematic meetings with a narrower focus were held, also targeting crypto market participants.

From October 2024, applications for preliminary review of MiCA licences in Lithuania began to be accepted. Individual consultations are organised as part of the dialogue with potential licensees. Within the Bank of Lithuania, a set of institutional preparation measures is being implemented: the organisational structure is being improved, internal processes are being formed, competences are being built up, and close cooperation with other state structures, including the Financial Crimes Investigation Service (FNTT). The final stage of these preparations was the approval of special licensing rules for cryptoasset service providers on 17 December 2024. These rules set out the procedure for the submission, content and forms of licence applications, as well as requirements for the composition of the accompanying documentation and procedural review of applications.

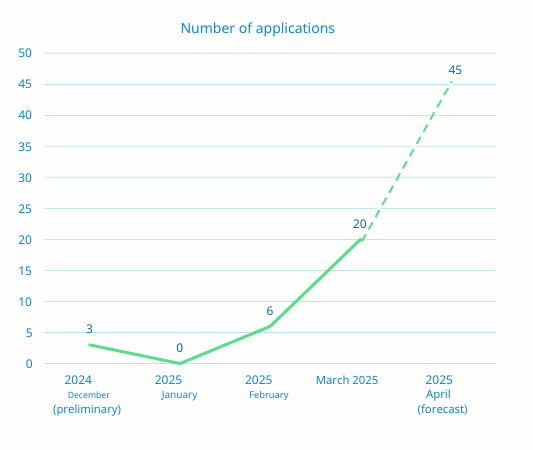

Number of MiCA licence applications submitted to the Bank of Lithuania

The licensing process for cryptoasset-related service providers in Lithuania is carried out under the direct application of Regulation (EU) 2023/1114 (MiCA), without introducing additional national requirements. Despite the formal readiness of the supervisory authority to accept applications, in 2024, the possibility to pre-assess the submitted documentation was realised by only three entities, which in turn were sent for finalisation. No new applications were received during January 2025, and the first full-fledged application was submitted only on 3 February.

The licensing process for cryptoasset-related service providers in Lithuania is carried out under the direct application of Regulation (EU) 2023/1114 (MiCA), without introducing additional national requirements. Despite the formal readiness of the supervisory authority to accept applications, in 2024, the possibility to pre-assess the submitted documentation was realised by only three entities, which in turn were sent for finalisation. No new applications were received during January 2025, and the first full-fledged application was submitted only on 3 February.

By mid-2025, the number of licence applications had reached 22, but most of them were found to be ineligible. The main deficiencies were the lack of confirmation of the origin of the CASP owners’ assets, non-compliance with goodwill requirements, and the overall poor quality of the submitted documents. As a consequence, applications were returned for revision within the prescribed five-day period, but the return does not deprive applicants of the right to resubmit – as of April 2025, 8 companies have already resubmitted corrected applications. The Bank of Lithuania has fully ensured institutional and methodological readiness to review applications as well as to conduct the entire licensing process during the transition period. Companies that have started preparations in a timely manner, engaged the relevant specialists and ensured the proper quality of the submitted materials retain the possibility of obtaining a licence until the deadline of 1 June 2025. On the other hand, service providers that have not completed the licensing procedure by this date will be required to suspend activities related to the provision of licensed crypto services until formal authorisation is obtained. Against the backdrop of the integration of European requirements into national regulation, Lithuania continues to strengthen its position as one of the key fintech hubs of the European Union. With MiCA coming into force, the country is considering further positioning itself as a jurisdiction favourable for the development of cryptocurrency and blockchain services infrastructure, which requires an assessment of both market potential and associated regulatory and reputational risks.

Stages of regulation of crypto companies in Lithuania

Until recently, cryptocurrency companies in Lithuania were perceived as financial market participants with a legal status that was not fully defined and clear, being on the periphery of the country’s regulated financial sector. However, with the entry into force of Regulation (EU) 2023/1114, better known as MiCA, the European Union finally approved the equality of cryptocurrency service providers with other financial institutions. These provisions were integrated into the national legal framework through the adoption of the Law of the Republic of Lithuania on Cryptoasset Markets in July 2024, which provides for the full implementation of MiCA into the Lithuanian legal system. From the beginning of 2025, the legal regime for service providers related to virtual assets has been significantly tightened. Companies previously limited to registration with the Centre of Registers and subject to supervision by the Financial Crimes Investigation Service (FNTT) are now required to undergo a full licensing procedure with the Bank of Lithuania. Initially, the deadline for obtaining a licence was set at 1 June 2025. However, in May it was decided to postpone this date: companies can continue to operate until 1 January 2026, provided that the licensing application is submitted in time and subsequently approved.

From this date onwards, providing cryptocurrency services without a valid licence will qualify as a breach of regulatory requirements. This decision aims to ensure a high level of transparency and sustainability of the market, as well as to enhance consumer protection and prevent abuses related to money laundering and terrorist financing. Against the backdrop of the changes taking place in the EU, member states are actively competing to attract international crypto companies and crypto exchanges. The first MiCA licences were issued in the European Union as early as the end of 2024, and by the end of July 2025, the total number of licences issued in the European Union was over 30. According to the supervisory authorities (ESMA, Germany is the leader in terms of the number of licences approved (14 licences), followed by the Netherlands (11), France (6) and Malta (5).

Among the major industry players that have already received licences in various EU countries are Bitpanda (Austria), Bybit (Austria), eToro (Cyprus), Bitstamp (Luxembourg), and digital bank N26 (Germany). This trend emphasises the growing importance of legal jurisdiction and regulation as strategic factors for large-scale crypto market participants.

Bank of Lithuania – regulator of crypto companies in Lithuania

The first half of 2025 was a period of particularly high activity in the fintech market. VASP companies registered in Lithuania sought to adapt to the new regulatory conditions and pass licensing under MiCA. However, despite the high interest, a significant number of applicants faced objective difficulties related to both the complexity of the European regulation and additional requirements imposed by the Bank of Lithuania in the process of assessing the eligibility of applicants. From the beginning of 2025, the Bank of Lithuania started accepting applications for a cryptoasset service provider licence, having previously ensured the necessary administrative and expert readiness to process the anticipated large number of applications. Additional human resources were mobilised to ensure timely and quality analysis of submitted documents and assessment of applicants’ compliance with legal requirements.

Despite expectations, there was no mass flow of applications at the beginning of the year, said Gediminas Šimkus, Governor of the Bank of Lithuania. Market participants focused on preparing the necessary package of documents and emphasised that the requirements are extremely high. This is due to the fact that licensees operating in the cryptoasset sector are equated to financial institutions by their legal status, and are therefore obliged to meet a similar level of regulatory standards.

Despite expectations, there was no mass flow of applications at the beginning of the year, said Gediminas Šimkus, Governor of the Bank of Lithuania. Market participants focused on preparing the necessary package of documents and emphasised that the requirements are extremely high. This is due to the fact that licensees operating in the cryptoasset sector are equated to financial institutions by their legal status, and are therefore obliged to meet a similar level of regulatory standards.

The basic criteria cover a wide range of requirements, including corporate governance, internal processes, controls and qualifications of key individuals. Applicants are required to establish a transparent organisational structure with clear segregation of duties between members of management, implement an effective internal control system to ensure sustainable compliance with regulatory requirements, and demonstrate a professional management team with the necessary qualifications, experience and impeccable business reputation.

Applicants are also required to submit a sound and structured business plan, which should describe the operating model, the list of proposed services, the technology to be used and a risk analysis. Financial requirements include a minimum authorised capital, the amount of which varies depending on the category of services provided. In addition, internal policies and procedures on anti-money laundering, consumer protection, information security and labour standards are a key requirement. All these measures are aimed at creating a sustainable, transparent and law-abiding environment for cryptocurrency services under a single European regulation.

Despite initially low activity at the beginning of the year, by the end of the first quarter of 2025 there was a sharp increase in the number of applications submitted for a cryptoasset service provider licence. Aware of the approaching 1 June deadline and the need to comply with the requirements of Regulation (EU) 2023/1114, existing market participants began submitting applications to the Bank of Lithuania en masse. This caused a significant increase in the workload of the supervisory authority, which, in turn, led to delays in the review of documents and increased tension in communication between the regulator and applicants. Given the limited time and the complexity of the licensing process, crypto companies started to actively request an extension of the deadline, pointing to the need for legal certainty and predictability of administrative procedures. Taking into account these circumstances, as well as the need to ensure equal access to licensing for all stakeholders, the Seimas of the Republic of Lithuania approved amendments to the current legislation in May 2025, extending the mandatory licensing deadline until 1 January 2026.

This step demonstrated the flexibility of Lithuanian legislation and the willingness of the authorities to ensure a balanced implementation of MiCA regulation without creating administrative barriers. As a result, Lithuania continues to attract positive interest from the international cryptocurrency community and is seen as a jurisdiction that combines legal predictability with favourable conditions for the development of fintech initiatives. The decision to extend the mandatory licensing period for cryptocurrency service providers has resonated positively among both existing Lithuanian market participants and international investors. This measure not only reduced administrative pressure on companies operating in the cryptoasset sector, but also provided them with additional time to thoroughly prepare applications that meet both the letter of the law and the practical expectations of the Bank of Lithuania. The regulator’s loyal stance and political will to create a balanced regulatory environment have strengthened Lithuania’s attractiveness as a jurisdiction open to technological investments and progressive financial solutions. The clear message sent by the authorities to both domestic and foreign cryptocurrency companies emphasises the country’s strategic course towards the development of a regulated and transparent digital finance infrastructure. At the same time, it should be noted that the cryptocurrency sector is already making a significant contribution to the Lithuanian economy, generating millions of euros in tax revenues annually.

By creating a favourable institutional environment, Lithuania demonstrates its readiness to cooperate with responsible investors and service providers capable of ensuring a high level of business ethics, compliance with international standards and sustainability of business models. Progressive legislation, flexible and professionally trained regulator, developed infrastructure of consulting and legal services, availability of qualified personnel and solvent audience – all this forms sustainable competitive advantages of the Lithuanian jurisdiction. One of the landmark success stories of the Lithuanian crypto market was the receipt of a cryptoasset service provider licence by Robinhood Europe, UAB, a subsidiary of US fintech leader Robinhood. The licence issued in May gives the company the right to provide services covering the entire European Union, using Lithuania as its regulatory base. This decision confirms the confidence of global players and reinforces Lithuania’s status as one of the most attractive digital finance centres in the EU.

First MiCA licence issued in Lithuania

On 30 May 2025, Lithuania issued its first cryptoasset service provider licence under Regulation (EU) 2023/1114 (MiCA). The recipient of the licence was UAB Robinhood Europe, the European division of the American fintech group Robinhood, known for its contribution to the democratisation of investing and the active involvement of a new generation of users in financial markets. Thus, Lithuania has officially joined the number of EU states that have started the practical implementation of the licence model of crypto sector regulation according to MiCA standards. Notably, in addition to the Lithuanian licence, Robinhood has also recently strengthened its presence in the European crypto market by acquiring Luxembourg-based MiCA-licensed crypto exchange Bitstamp, effectively making the group the holder of two independent permits under a single EU regulation. This confirms the strategic intention of to establish itself in the European market as a legal and regulated cryptocurrency service provider. According to the latest data from the Bank of Lithuania, the total number of MiCA licence applications has reached 29, of which ten are pending. The regulator reminds about the possibility of pre-assessment of documents, a mechanism that allows for five working days to receive feedback on the draft application before it is officially submitted. At the same time, the full licensing process, according to the regulator, may take four to five months, and even longer if additional inspections are required. Global cryptocurrency giant Binance, whose Lithuanian subsidiary Bifinity is already one of the country’s largest taxpayers, is among the companies that have expressed their intention to be licensed in Lithuania. Despite the fact that Binance’s activities in the international legal sphere have a certain reputational imprint due to the admission of the guilt of CEO Changpeng Zhao in cases related to money laundering in the United States, the possible obtaining of a MiCA licence in Lithuania may significantly strengthen the country’s position as a regional cryptohub. This circumstance is seen as a potential opportunity to repeat the success of the Lithuanian fintech sector, which has put the country among the leaders of the European Union in terms of the number of issued specialised licences.

Lithuania has consistently maintained its status as one of the leading fintech centres in Europe. As of 2025, there were 282 fintech companies in the country. The total number of professionals in the sector has reached 8,000, with an average salary of over €3,900 before taxes. In the past year, fintech companies processed payments worth around €140 billion, up 40 per cent from the year before.

Despite the higher level of regulatory risks in the crypto sector compared to other fintech sectors, licensed cryptocurrency service providers in Lithuania are granted the status of full-fledged financial market participants whose activities are under the constant supervision of the Bank of Lithuania and comply with European regulatory standards. State authorities recognise the potential of this sector subject to passing national security checks, real presence in the country and willingness to invest in local resources – both human and technological. In this context, Lithuania sees the crypto sector as one of the drivers of the country’s long-term growth, capable of contributing to the development of the knowledge economy and digital infrastructure.

MiCA regulations in Lithuania 2025

With the steadily increasing interest of international investors in the Lithuanian cryptocurrency services market and against the background of the approaching deadline for mandatory licensing under Regulation (EU) 2023/1114 (MiCA), the Seimas Committee on Budget and Finance held an extended meeting with the participation of representatives of key government and supervisory authorities, as well as participants in the cryptocurrency sector. Delegates from the Ministry of Finance, the Bank of Lithuania, the Financial Crimes Investigation Service and industry associations representing the interests of cryptocurrency companies took part in the discussion.

One of the central topics of the meeting was an analysis of the timeframes set for going through the licensing procedure. Under MiCA, all cryptoasset service providers are required to obtain a licence from the Bank of Lithuania by 1 June 2025. However, as noted during the discussion, the current transition period of five months is too short compared to other EU countries, where adaptation periods range from six to eighteen months. It was emphasised that this time constraint could cause a slowdown in investment inflows, job losses and even the withdrawal of certain businesses to more flexible jurisdictions.

According to the Bank of Lithuania, more than 400 crypto service providers have been registered in the country, of which around 120 are still active. Despite this, only 22 companies have so far submitted full licence applications. Most market participants are still at the stage of preparing the necessary documentation. The business community, for its part, recalled the sector’s significant contribution to the country’s economy. For the period 2023-2024 alone, crypto sector companies transferred about 90 million euros to the budget, with the five largest players providing more than a third of this amount. Industry representatives emphasise the importance of legal predictability and stability, as the lack of transparent and balanced rules can destabilise the market and undermine investor confidence.

According to Algirdas Sisas, Chairman of the Budget and Finance Committee, Lithuania is striving to create a competitive, modern regulatory framework that complies with international standards and provides legal certainty for all financial market participants. Mikolas Majauskas, President of the Cryptoeconomy Organisation, reiterated the need to implement regulation, stressing that MiCA provides a level playing field across the EU, fostering trust and formalising the sector. However, he called for proportionality in the process of implementing new regulations to avoid negative consequences for the development of the industry. In order to ensure a balanced transition to the licensing regime, the Budget and Finance Committee decided to register legislative amendments to extend the mandatory licensing deadline to 31 December 2025. This will allow applicants to finalise preparations and supervisory authorities to ensure quality and timely examination of applications.

Thus, Lithuania continues its course towards institutionalisation of the crypto sector, considering MiCA as a tool to not only strengthen the financial stability and transparency of the market, but also to strengthen the country’s position as one of the leading fintech centres in Europe. Successful implementation of this regulatory framework will require a delicate balance between supervisory interests, security requirements and the need to maintain a competitive business environment. Lithuania is demonstrating a rapid transition from being a jurisdiction with a flexible approach to regulating cryptoassets to one of the most strictly supervised and regulatory-intensive legal environments in the European Union. This transition is driven by the immediate implementation of the provisions of the Markets in Cryptoassets Regulation (EU) 2023/1114 (MiCA), coming into force on 30 December 2024. Unlike a number of EU Member States that took advantage of the possibility of delayed implementation for up to 18 months, Lithuania decided to implement the regulation in full without a transition period, reflecting the political will to create a highly standardised regulatory model.

This decisive step demonstrates the Lithuanian authorities’ systematic strategy to enhance financial transparency, counter abuses in the virtual asset market and minimise the risks associated with money laundering and the financing of illicit activities. The key institutions behind the implementation of this policy are the Bank of Lithuania and the Financial Crimes Investigation Service, which have already taken a number of preventive measures ahead of the mandatory provisions of MiCA. These measures include a ban on anonymous cryptocurrency accounts, increased capital structure requirements for crypto-service providers, as well as enhanced corporate governance and internal control requirements. These actions emphasise the focus on creating a sustainable, transparent and regulated ecosystem capable of balancing the innovative development of the crypto sector with the necessary elements of financial stability and oversight.

One of the key areas of focus was strengthening consumer protection. New regulations oblige cryptocurrency service providers to disclose information about risks, storage technologies and data processing rules, as well as to comply with customer identification (KYC) and anti-money laundering (AML) requirements. Strict standards have been set to eliminate anonymity and increase minimum capital. For the end user, this means increased trust in platforms and reduced risk when transacting in digital assets. Transaction transparency has also reached a new level. Under MiCA, all cryptocurrency transfers over €1,000 are subject to mandatory sender and recipient identification, bringing crypto transactions closer to banking sector standards. For consumers, this means additional verification for large transactions, especially in cross-border settlements, but it also means reducing the risks of fraud and unscrupulous transactions.

Despite high barriers to entry, Lithuania remains an attractive jurisdiction for major players: several international crypto platforms have already obtained licences in the country. This contributes to the confidence in the Lithuanian market and stimulates the development of local IT and fintech ecosystems. This opens up prospects for creating technology partnerships, attracting investments and expanding the range of available digital financial services. At the same time, the high requirements may become a serious challenge for small startups and P2P providers, which are forced to either stop operating or adapt through participation in special regulatory sandboxes. The fiscal aspect has also taken on special significance. Income from cryptocurrency transactions is subject to declaration and taxation at the income tax rate. Although transactions are not subject to VAT, tax authorities expect individuals to take into account income from trading, DeFi, eirdrops and other digital activities. Further clarification on this issue is expected, particularly in relation to new forms of assets.

Against the backdrop of the new requirements, controls on small transactions are also tightening. Individuals making transactions over €1,000 are required to provide with identity documents and bank details, even for one-off transactions via P2P services or wallets. This means the end of the era of anonymous crypto-trading in Lithuania and the formation of a regulated, traceable environment for digital assets. The MiCA reforms simultaneously create conditions for long-term stability, transparency and consumer protection, but require rapid adaptation by all market participants. In the medium term, Lithuania’s rigorous approach can turn the country into a reliable and sustainable element of the pan-European digital finance architecture, where compliance with regulatory standards becomes the basis for trust and growth.

Thus, the new Lithuanian crypto-regulatory landscape is characterised by a high degree of institutional maturity and integration into the European legal system. This makes the country attractive not only for technologically advanced and ethically sound companies, but also for investors interested in a stable, regulated and predictable environment for digital asset transactions. Lithuania has demonstrated an unprecedented transformation in digital asset regulation, transforming from a liberal, minimally supervised jurisdiction to one of the most highly regulated and institutionally advanced cryptocurrency ecosystems in the European Union. Key to this change was the immediate implementation of the provisions of the Markets in Cryptoassets Regulation (EU) 2023/1114 (MiCA), which came into force on 30 December 2024. While most EU Member States have exercised the right to an 18-month transition period, Lithuania has refused to delay and has started the immediate implementation of MiCA provisions.

This approach underlines the determination of the state authorities – primarily the Bank of Lithuania and the Financial Crimes Investigation Service (FNTT) – to build a sustainable, transparent and long-term regulatory model in line with European standards of financial stability and legal supervision. Moreover, even before MiCA officially came into force, the country had already implemented measures such as a ban on anonymous cryptocurrency accounts, stricter capital requirements for service providers and preliminary control of the corporate structure of companies dealing with virtual assets. For individuals who do not regularly transact with cryptoassets, use digital wallets or consider cryptocurrencies as a long-term investment instrument, the new regulatory environment creates conditions of increased security, legal certainty and predictability. Increased requirements for market participants cut out unreliable and speculative structures, while creating an attractive and safe platform for bona fide and regulated service providers.

The Lithuanian crypto-regulatory model focuses not only on strengthening controls, but also on creating a sustainable business climate in which innovative companies can operate within well-defined and transparent rules. This opens up opportunities for the inflow of institutional investors, scaling of high value-added projects and active development of the fintech environment. Thus, Lithuania is establishing itself as a regional leader in cryptoasset regulation, building a digital economy that combines technological openness, legal stability and protection of market participants’ interests. The strategic line aimed at attracting mature and legally responsible companies contributes to building trust, developing the sector and establishing the country’s reputation as a reliable centre for cryptocurrency and fintech services in the European Union.

Company in Lithuania UAB offers professional support to cryptocurrency entrepreneurs interested in obtaining a licence under the MiCA Regulation in Lithuania, one of the most progressive jurisdictions of the European Union in the field of virtual assets regulation.

From 2025, the entry into force of MiCA (Markets in Crypto-Assets Regulation) means strict requirements for all cryptoasset-related service providers wishing to continue to operate legally in the EU. Lithuania, with its stable legal system, transparent regulatory practices and favourable business environment, is becoming an attractive destination for registration and licensing of crypto-companies.

Company in Lithuania UAB provides comprehensive services for the preparation and submission of MiCA licence application to the Bank of Lithuania, including:

- Legal and regulatory due diligence of the project in accordance with MiCA and national legislation;

- Preparation of all necessary documentation, including AML/CTF internal policies, risk management rules, compliance structure and business plan;

- Supporting the company incorporation process and appointment of officers who meet the requirements of experience, business reputation and qualifications;

- Advising on organisational structure, share capital and resourcing;

- Interaction with the regulator at all stages of obtaining a licence.

Based on many years of experience in supporting FinTech projects and a deep understanding of European regulatory requirements, Company in Lithuania UAB offers a turnkey solution for crypto-companies planning to operate under MiCA. Thanks to a high level of trust from clients and effective interaction with regulatory authorities, the company helps to accelerate the licensing process and minimise regulatory risks. If you are interested in obtaining a MiCA licence in another European country, our company can help you with this.